The Enterprise Risk Manager™ is a next generation enterprise risk management (ERM) software solution. This groundbreaking solution is based on a unique methodology that integrates the key features of Corporate ERM/GRC (threat management), Financial Services ERM (tactical risk management) and strategic risk management within a single, all-encompassing ERM framework. The Enterprise Risk Manager is also the only solution that facilitates risk based decision-making and can transform ERM from a compliance exercise into a process that adds substantial value. This highly intuitive and user-friendly tool leverages the industry's most advanced risk analytics and yet requires virtually no prior knowledge of mathematics or statistics. The Enterprise Risk Manager is applicable across all industries, globally.

Key Features and Functionality

- The only tool that allows for the systematic assessment/measurement of each and every enterprise risk, including all business, market, credit, insurance, legal, strategic and operational risks, at any level of granularity; applicable across all industries, globally.

- Based on a methodology that addresses virtually every known conceptual/technical problem in risk measurement and management – including some that have never been clearly defined.

- Offers a myriad of practical benefits: allows for the estimation of key decision variables including risk premiums for pricing; facilitates the evaluation of risk-reward, risk-control and risk-transfer trade-offs – at the risk tolerance level of the stakeholders; enables informed decision-making across a range of risk management business problems.

- The only tool that can perform the "impossible" task of estimating an entire risk curve with just one probability-loss input or one loss data point; can accommodate empirical loss data, expert opinion and both together.

- Leverages proprietary new technology, including the ALEC/LEC method, arguably the industry’s most advanced risk quantification technique, and an ultra high speed Monte-Carlo simulation engine, which produces virtually instantaneous results.

- Deceptively simple; the tool’s intuitive and user-friendly interface belies its technical sophistication. Perfectly suited for executive decision-makers interested in evaluating the pros and cons of different business strategies in real time.

- Currently available in Chinese, English, French and German. Additional language options forthcoming.

The Enterprise Risk Manager’s quantification engine is based on the ALEC/LEC method, which is arguably the most advanced and versatile methods of quantifying risk in existence today. The methodology underlying these tools addresses virtually every known theoretical/practical risk quantification problem as well as some that have never been clearly defined, including:

- 1) How to accurately model loss data that are heterogeneous, truncated and contain outliers – the so called black-swan events.

- 2) How to robustly rank, assess or measure risk using only expert opinion.

- 3) How to combine expert opinion with empirical loss data in an objective, transparent and theoretically valid manner.

Summary of Technical Features

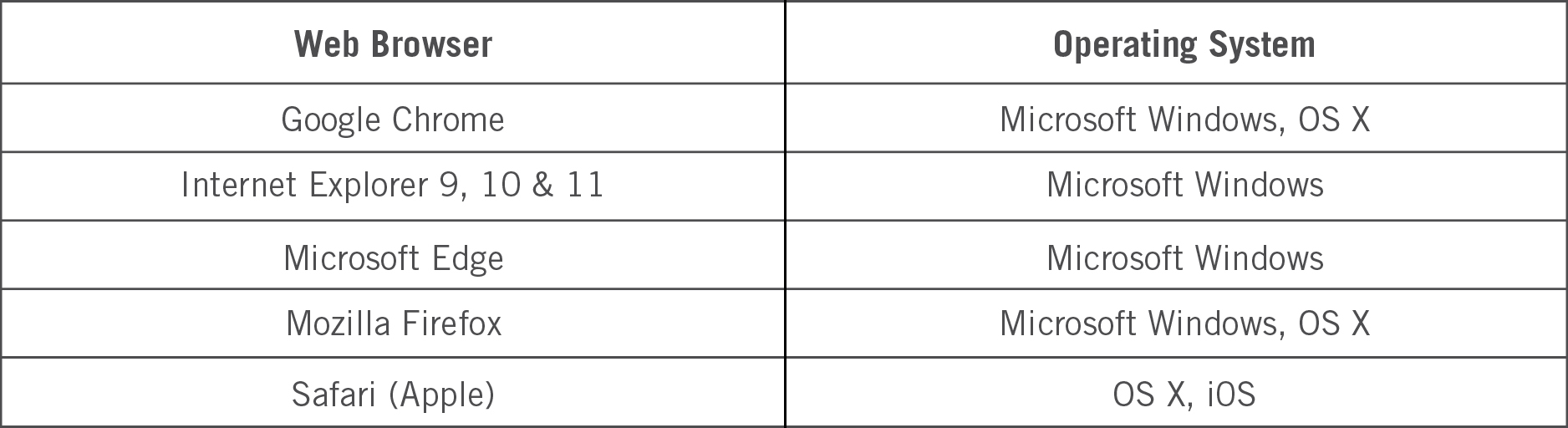

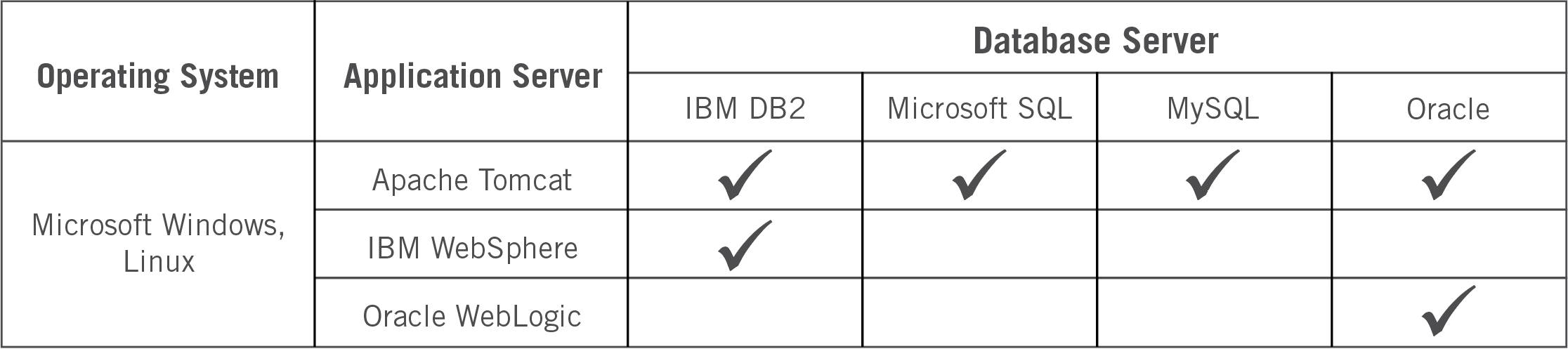

The Enterprise Risk Manager is a web-based client-server application and is offered as a self-hosted or cloud-based solution. The solution has been developed using the Java Platform, Enterprise Edition (Java EE) architecture, and is compatible with most commercial web browsers, operating systems, application servers and database servers, as illustrated below.